IPBES can provide clarity on biodiversity metrics

The Impact Assessment working group of the Finance for Biodiversity Foundation provided collective input on the IPBES Business & Biodiversity consultation in December 2021. For the working group, it was very important to contribute to the consultation to align finance practices with science and the current state of biodiversity and ecosystem services and vice versa.

“Biodiversity is still an emerging topic for most asset managers and banks. We have noticed some challenges financial institutions are facing in choosing relevant biodiversity metrics adapted to their ESG analysis framework, asset classes and regulatory environment. IPBES can provide some scientific evidence for underpinning methodologies used by these metrics to evaluate anthropogenic pressures, so the finance sector can safely rely on them to monitor the impact of investments and financial products”, says Hadrien Gaudin-Hamama (Mirova), member of the Impact Assessment working group.

IPBES is the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services. It does periodic global assessments on the state of biodiversity and ecosystem services. IPBES also aims to identify policy-relevant tools and methodologies, facilitate their use, and catalyze their further development.

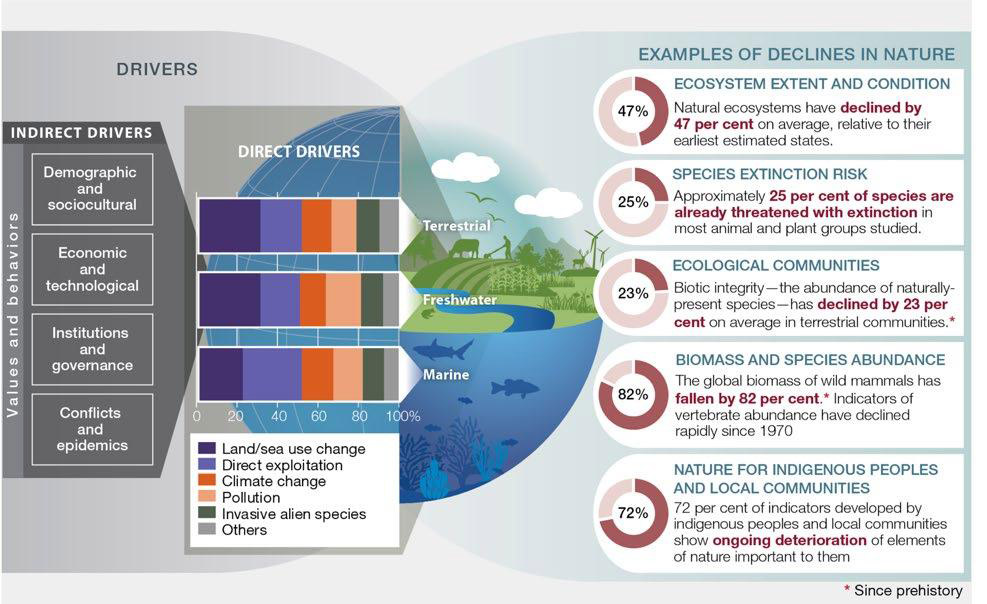

Drivers of biodiversity loss

IPBES has identified several drivers of biodiversity loss, which are divided into the following areas:

- Terrestrial

- Fresh water

- Marine

Within these areas, the direct drivers are:

- Land and sea use change

- Direct exploitation

- Climate change

- Pollution

- Invasive species

See also the figure below.

Figure: Drivers of biodiversity loss and examples of declines in nature. Source IPBES Global Assessment Report 2019